Global Marketing Pulse: Week Ending October 24, 2025

🚨 The AI Accountability Crisis: Europe Puts Tech Giants on Notice

The major headline of the week centered on the European Union’s aggressive enforcement of the Digital Services Act (DSA). On Friday, the European Commission announced preliminary findings that Meta (Facebook/Instagram) and TikTok are in breach of their transparency and content-flagging obligations under the DSA. This move signals a new era where regulatory compliance directly impacts fundamental product design, especially concerning AI systems.

🇪🇺 Europe & UK: Compliance and Consequences

The week was defined by the tangible legal risks faced by tech giants, forcing all European brands to re-evaluate their digital integrity.

Meta and TikTok Face DSA Breaches

The European Commission’s preliminary findings focused on two critical areas:

1. Ineffective Content Flagging: The Commission found that Meta’s mechanisms for users to flag illegal content (such as child sexual abuse material or terrorist content) are complex and non-user-friendly. Crucially, they accused the platforms of using “dark patterns”—deceptive interface designs—to discourage users from reporting content or challenging moderation decisions.

2. Research Data Obstruction: Both Meta and TikTok were found to be in breach of obligations to grant researchers easy access to public data needed to study the platforms’ systemic effects, particularly concerning the safety and impact on minors.

The Stake: If these breaches are confirmed, the companies face fines of up to 6\% of their total worldwide annual turnover, highlighting the colossal financial risk attached to non-compliance. This sent an urgent message to all brands operating in the EU: privacy and user safety must be prioritized over ad revenue gains.

UK: Ad Spend and Subscription Model Shifts

• Meta Subscription Test: Following the EU rollout, Meta expanded its ad-free subscription model to the UK. For brands, this development signals a potential shrinkage of advertising inventory and an increase in ad costs, pushing marketers to focus heavily on first-party data strategies and maximizing the efficiency of their remaining ad budgets.

• The Localization Lever: UK marketing intelligence noted the “Vibe Marketing” trend is accelerating. Brands are abandoning generic global campaigns in favor of hyper-localized creative. Instead of a single UK ad, brands are creating week-to-week content tuned to regional slang, weather, and micro-cultural moments, leveraging AI to manage this massive content scale.

🇺🇸 USA: AI Agents and Omnichannel Excellence

In North America, the focus was firmly on how AI is integrating into backend systems, and how brands are locking down their tech stacks for the critical holiday season.

AI Transitions from Tool to Team Member

AI in the US is moving beyond simple text generation to creating autonomous “AI Agents” that handle end-to-end operational tasks.

• Automotive Supply Chains: BMW Group, in collaboration with Monkeyway, is using an AI solution called SORDI.ai to optimize its industrial planning. This AI system scans assets and creates 3D digital twins using Google Cloud’s Vertex AI to run thousands of supply chain simulations, dramatically optimizing distribution efficiency and reducing logistics waste.

• Conversational Commerce (Auto): General Motors’ OnStar is leveraging advanced conversational AI powered by Google Cloud to create a Virtual Assistant that offers superior intent recognition for drivers. Similarly, Mercedes-Benz is integrating generative AI into its online storefront to power a smart sales assistant, making the e-commerce journey for luxury vehicles more personalized and intuitive.

Retail Media and Social Commerce Integration

• Retail Media Battle: The competition in retail media intensified, with Instacart announcing it is the first retail media partner to enable targeting and end-to-end measurement directly within TikTok’s ad platform. This integration allows CPG brands to target audiences based on their grocery purchase history and measure the direct impact of TikTok video ads on sales—a huge step for performance tracking.

• WPP’s Internal AI Agency: Global ad holding company WPP launched its new platform, WPP Open Pro, which allows small and medium-sized business clients to plan, create, and deploy campaigns independently using AI—an example of agency groups effectively productizing their intelligence and empowering smaller brands while keeping them within the larger WPP ecosystem.

🇨🇳 China & 🇯🇵 Japan: Regulatory Transparency and E-Commerce Tax

Asia’s marketing news this week was dominated by a major regulatory shift impacting cross-border e-commerce platforms, forcing transparency in pricing and operations.

China’s New E-Commerce Tax Regulation

Starting October 1, 2025, a new Chinese tax regulation took effect, mandating that all internet platform enterprises operating within China (including giants like Temu, SHEIN, TikTok Shop, and AliExpress) must report detailed tax-related information, including order amounts, turnover, and payment records.

• Brand Impact: International sellers and large cross-border e-commerce platforms are adjusting prices and supply chains to cope with the increased compliance costs. While some prices may rise, the long-term trend is toward a fairer, more transparent marketplace for international buyers, reducing instances of tax evasion and improper pricing strategies.

• The XHS Credibility Engine: Platforms like Xiaohongshu (XHS) continue to gain authority. With 74\% of its 300 million users consulting the platform before making a purchase, micro-KOL and user-generated “RedNotes” remain the most valuable marketing assets for establishing product trust and driving high-converting “grass planting” campaigns.

🇦🇪 Middle East (MENA): Brand Purpose and Regional Expansion

The MENA region demonstrated an accelerating trend of blending deep market expansion with purpose-driven campaigns.

Purpose-Driven OOH and Social Campaigns

• Nezo Salt’s Pinktober Campaign: Nezo Salt launched a highly visible campaign for Breast Cancer Awareness Month across the UAE, Qatar, and Bahrain, using Out-of-Home (OOH) media across high-traffic metro stations, digital retail screens, and buses. The campaign tied the health benefits of its Himalayan Pink Salt to the message of self-care and free screenings, successfully blending brand purpose with mass media presence at key consumer touchpoints.

• Wendy’s GCC Launch: The Wendy’s Company marked a strategic expansion into the Gulf Cooperation Council (GCC) by appointing a new regional partner to launch a 360-marketing campaign aimed at building brand awareness in Saudi Arabia. This signifies sustained confidence by US QSR giants in the aggressive market growth and high consumer spending of the GCC region.

Qatar’s Fintech and AI Acceleration

• Banking Goes Digital-First: Banks in Qatar are leading a rapid fintech revolution powered by AI. Qatar National Bank (QNB) Group’s digital-first entity, ezbank, received licenses to expand into Saudi Arabia and Egypt in October. The platform aims to offer simple, secure, and mobile-first banking solutions, relying heavily on AI-driven tools and smart risk management to streamline transactions for youth and entrepreneurs across the region.

This week showcased that the future of marketing is split: hyper-efficient, AI-driven automation is winning the creative speed race, but the battleground for trust is moving squarely into the realm of compliance and ethical design, particularly in Europe.

What market trend caught your attention the most this week—the AI accountability crisis in Europe or the continued power of social commerce in Asia?

Related Insights

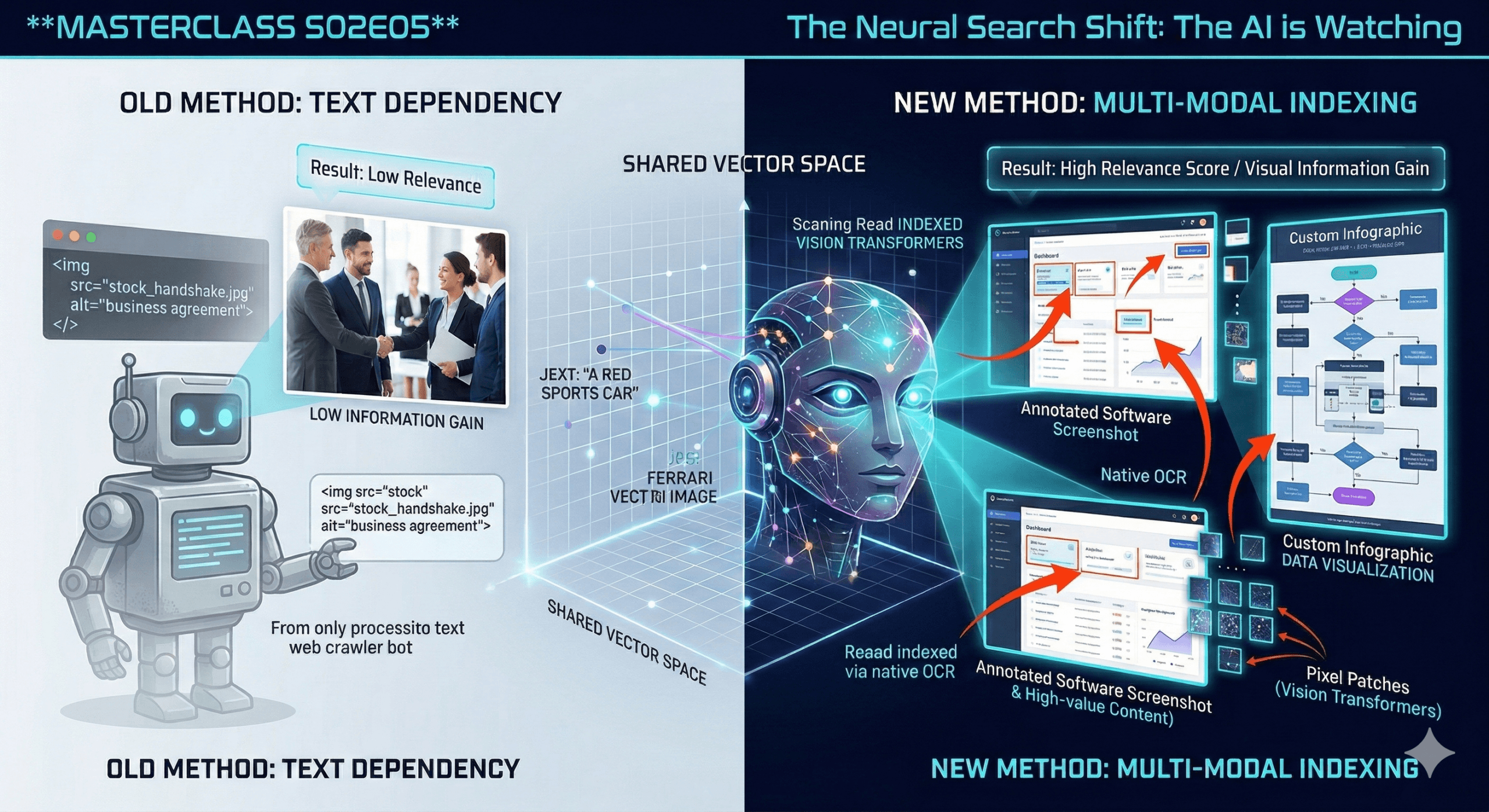

Visual Search & Multi-Modal Indexing | see how the AI is watching you

We are moving beyond text. The most profound shift in AI over the last 12 months isn’t just that it got smarter at reading—it’s that it learned to see. If…

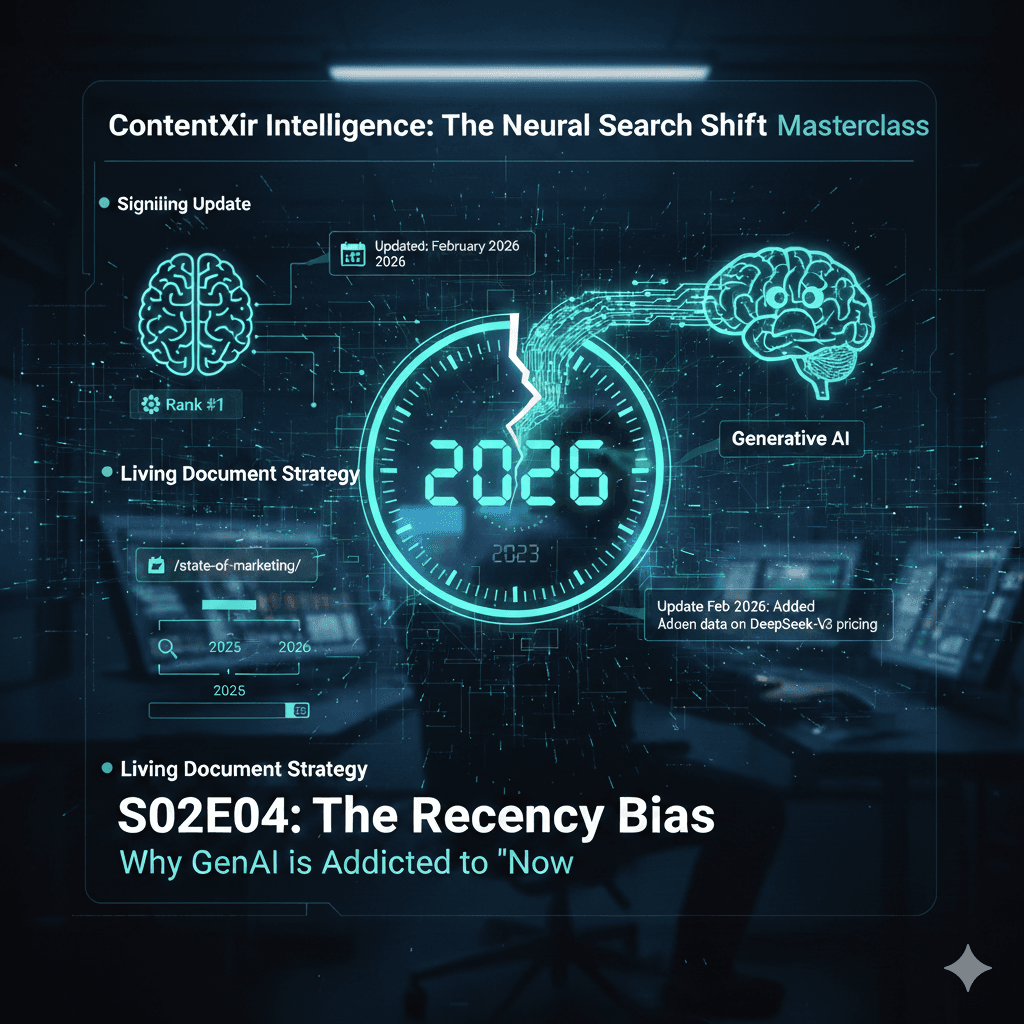

The Recency Bias | Why GenAI is Addicted to “Now”

We have discussed how to be cited. Now we discuss when to be cited. Generative AI has a massive insecurity: it knows its internal memory is outdated. Therefore, it over-corrects…

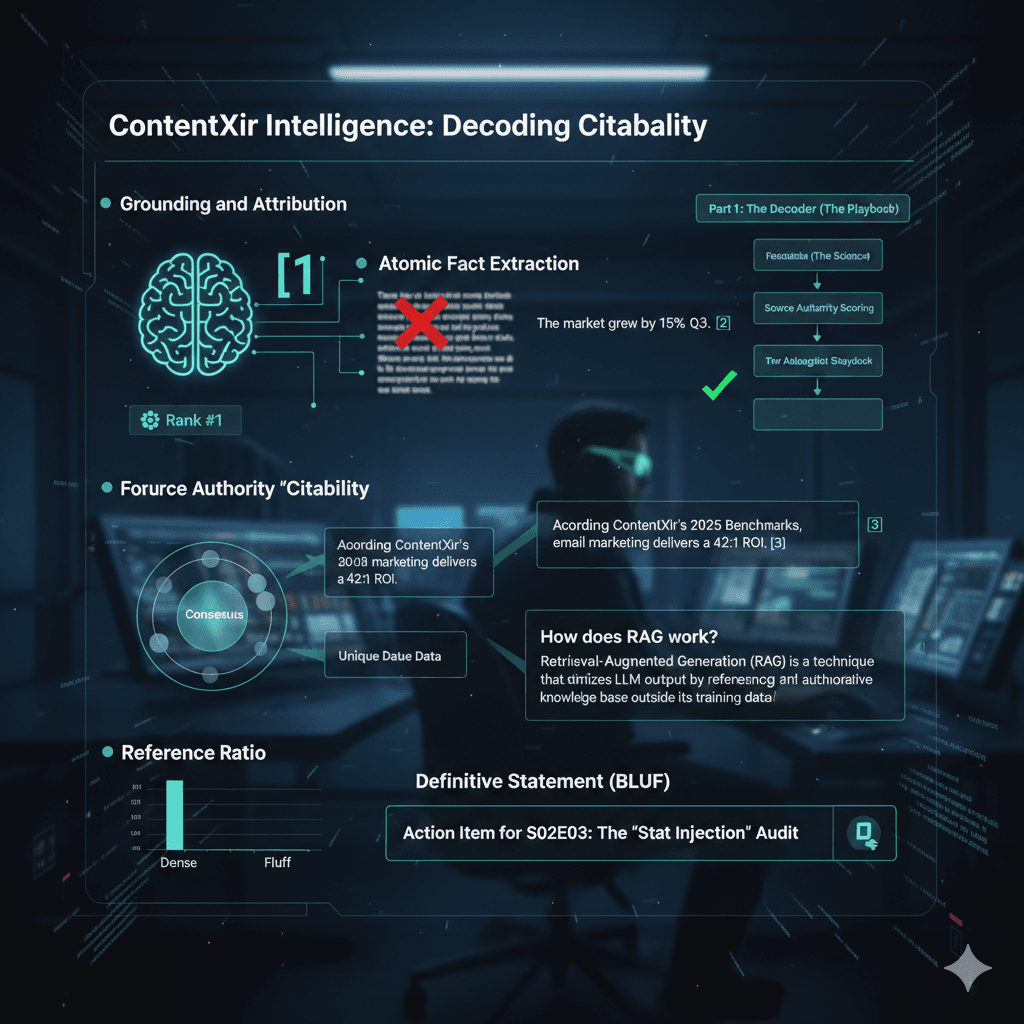

How to win the AIO | Crack the mystery of getting citation in generative search engine result

We are tackling the new currency of the web. Traffic is no longer the primary metric; attribution is. If the AI uses your data to answer a user but doesn’t…